- 2025 Firstmark Credit Union. All Rights Reserved.

- Website by Innov8 Place

ATM Machine Availability Update. Read the full message here

If you’re new to Digital Banking, you’ll need to provide some personal details to get you started:

After we verify your info, you will receive a Verification Code, which will allow you to create your credentials. Once you accept the Terms & Conditions, you can then begin exploring Firstmark’s Digital Banking platform!

Learn about the Digital Banking experience with Firstmark and how we empower our customers to control and manage their finances.

It’s easy to set up business online banking. Simply click Get Started and our online form will quickly guide you through the process.

Learn more about everything Firstmark’s Digital Banking offers and how to use it!

Add more security to an already secure Digital Banking experience with Push Authentication!

With Push Authentication enabled you will be notified if/when an attempt to log in to your account has occurred and have the ability to authorize access through a secure “Authorization Required” prompt.

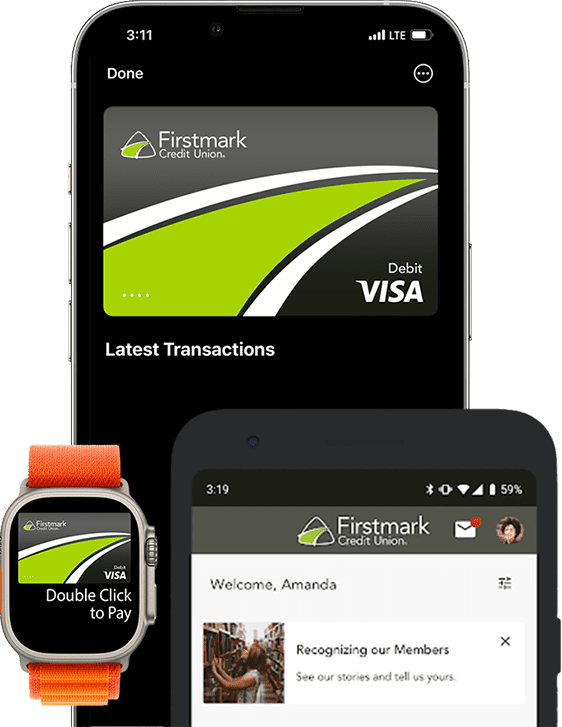

Enjoy the convenience of Digital Issuance and eliminate your wait time for a replacement credit card!

With Digital Issuance, there’s no waiting for your physical credit card, and you can continue making purchases right from your mobile device upon card verification. Digital Issuance also offers first-class security, safely storing your card information in the mobile app.

Digital Issuance is made possible through the usage of our Digital Wallet service feature!

| Apple | iOS 15, 16 |

| Android 12 – 15 | |

| Mozilla | iOS 15, 16

Android 12 – 15 |

Enjoy the convenience of Digital Issuance and eliminate your wait time for a replacement credit card!

With Digital Issuance, there’s no waiting for your physical credit card, and you can continue making purchases right from your mobile device upon card verification. Digital Issuance also offers first-class security, safely storing your card information in the mobile app.

Digital Issuance is made possible through the usage of our Digital Wallet service feature!

| Apple | iOS 15, 16 |

| Android 12 – 15 | |

| Mozilla | iOS 15, 16

Android 12 – 15 |

Set up the external account using instant account verification (primary account holder):

Once this process has been completed, you may select from your external account(s) under Transfer Between Accounts, making it easy to switch between accounts.