- 2024 Firstmark Credit Union. All Rights Reserved.

- Website by Innov8 Place

- Contact Us

- Careers

- Rates

- Locations

- Routing / Transit Number : 314088556

Holiday Closure: Our corporate office, call center, and financial centers will close at 1 p.m. on Tuesday, December 31, and be closed on Wednesday, January 1, in observance of New Year’s Eve and New Year’s Day. We look forward to serving you during regularly scheduled hours on Thursday, January 2.

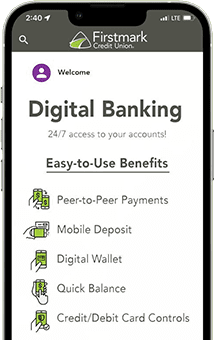

Scam Alert! We've been notified by our members that imposters are spoofing our phone number and are asking for personal information. As a reminder, we will NEVER call asking you to disclose confidential information. Please send us a secure message via Digital Banking if you have any questions.

We apologize for the long hold times. You may access your account balance(s), transfer funds, and make payments via Digital Banking and the Firstmark App. You can also leave us a call back number to avoid the wait or send us a secure message via Digital Banking. We appreciate your patience, and as always, thank you for your membership.